All Categories

Featured

Think About Making use of the cent formula: dollar represents Financial debt, Income, Home Mortgage, and Education. Complete your financial obligations, home mortgage, and university expenditures, plus your wage for the number of years your family members needs defense (e.g., till the children are out of your home), and that's your protection need. Some financial experts determine the amount you require utilizing the Human Life Value approach, which is your lifetime earnings potential what you're making currently, and what you expect to make in the future.

One means to do that is to look for business with strong Economic strength rankings. life insurance 10 year term meaning. 8A firm that finances its very own policies: Some business can offer policies from another insurance company, and this can add an extra layer if you intend to alter your plan or down the road when your family members requires a payout

How Does Decreasing Term Life Insurance Work

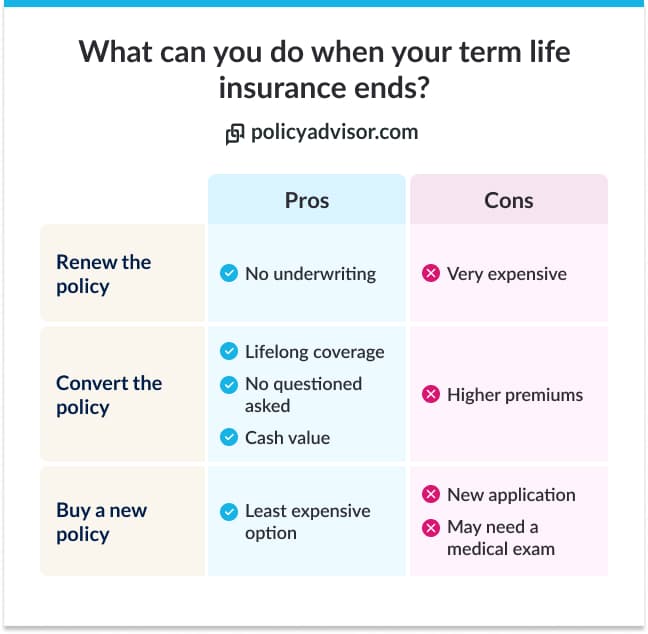

Some firms offer this on a year-to-year basis and while you can anticipate your prices to increase considerably, it may deserve it for your survivors. Another means to contrast insurer is by taking a look at online consumer testimonials. While these aren't likely to inform you a lot regarding a business's monetary security, it can tell you how simple they are to collaborate with, and whether cases servicing is an issue.

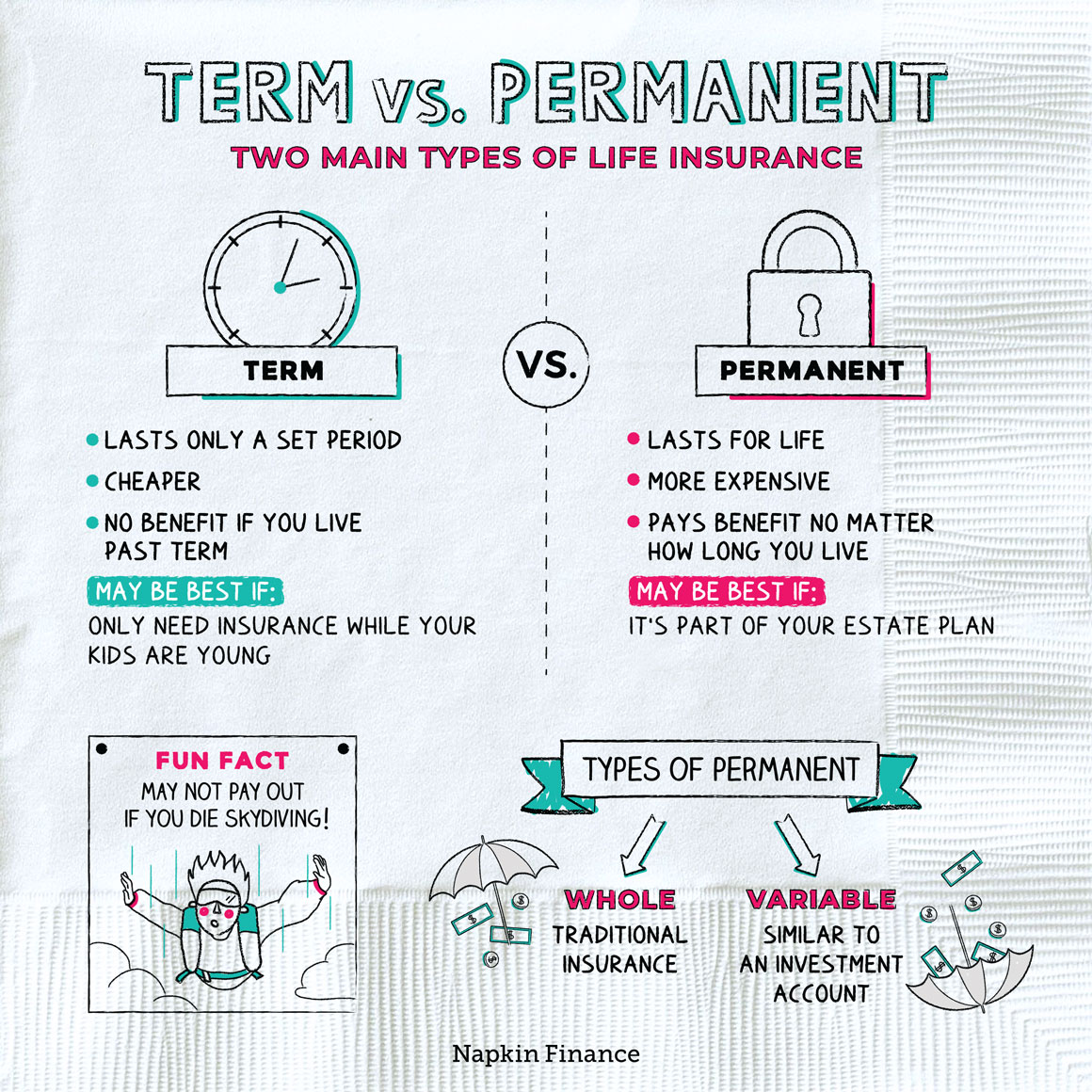

When you're younger, term life insurance policy can be a basic means to secure your liked ones. As life modifications your economic priorities can too, so you might want to have entire life insurance coverage for its lifetime protection and additional advantages that you can use while you're living. That's where a term conversion comes in - what is a 10 year level term life insurance.

Authorization is assured despite your health. The premiums will not enhance as soon as they're set, but they will rise with age, so it's a good concept to secure them in early. Find out even more about just how a term conversion functions.

1Term life insurance policy provides short-lived defense for a critical period of time and is typically less costly than permanent life insurance policy. decreasing term life insurance for mortgage. 2Term conversion standards and restrictions, such as timing, might apply; for example, there may be a ten-year conversion privilege for some items and a five-year conversion advantage for others

3Rider Insured's Paid-Up Insurance policy Acquisition Choice in New York. There is a cost to exercise this rider. Not all participating policy owners are eligible for rewards.

Latest Posts

How Long, Typically, Is The Grace Period On A $500,000 Level Term Life Insurance Policy?

Decreasing Term Life Insurance Is Often Used To

Joint Term Life Insurance Quotes